Case Study: Resilient Assets Command Better Coverage

kWh Analytics

Share

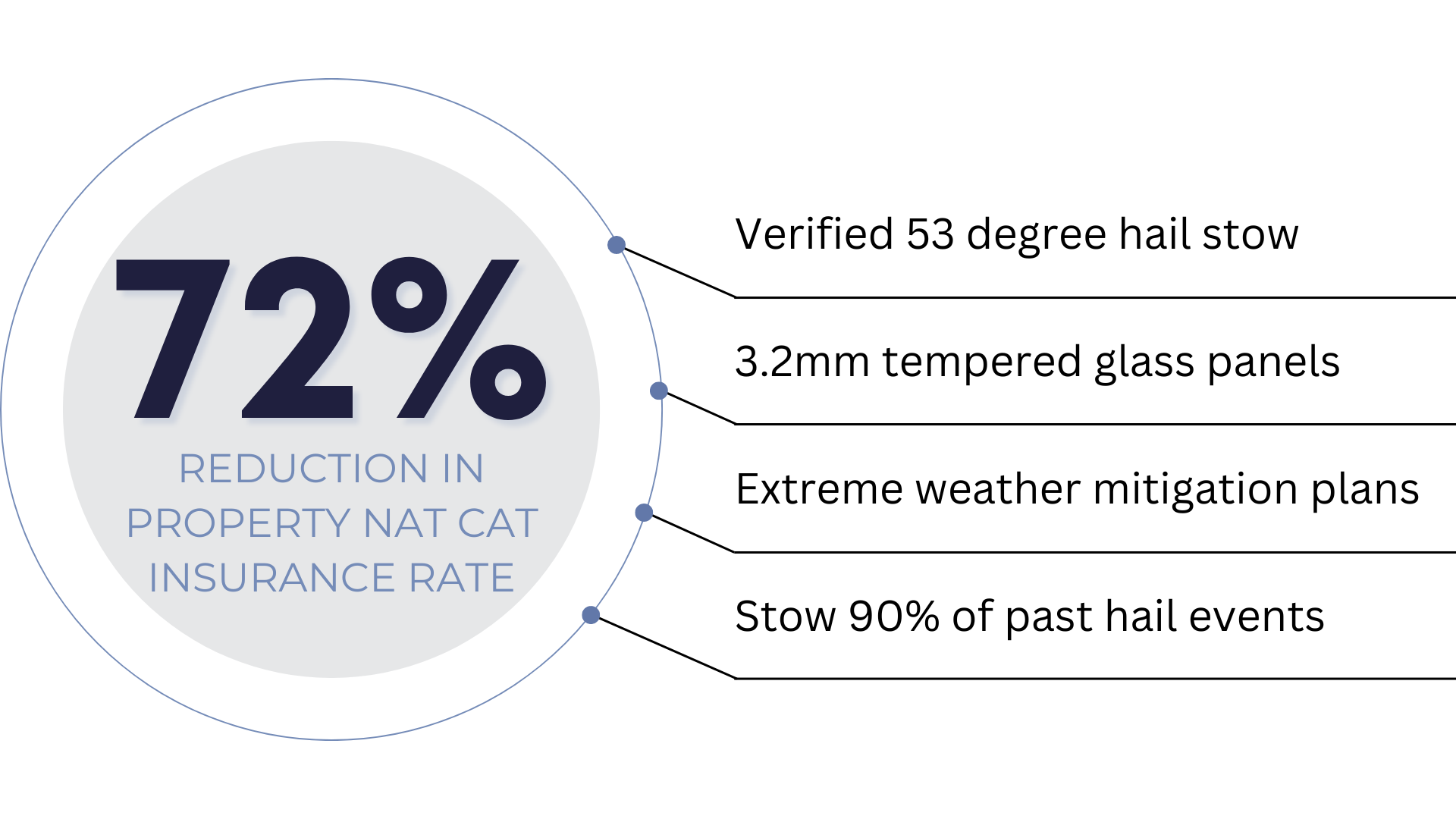

A utility-scale solar developer saw a 72% natural catastrophe rate reduction for employing resilient site design and operation

The Challenge

In a market where insurance rates for renewable energy projects are climbing, especially in hail-prone regions, asset owners face increasing pressure to protect their investments. This is particularly true in North Central Texas, where one developer sought coverage for their 140MW solar project valued at $100MM in a high hail risk area.

The Solution: Proactive Resilience Measures

The developer implemented a comprehensive strategy to harden their asset against natural catastrophes:

Physical Hardening:

- Installed 3.2mm tempered glass solar panels

- Used high-quality components across modules, inverters, and tracking systems

- Operational Protocols

- Implemented a verified 53-degree hail stow angle

- Developed comprehensive extreme weather mitigation plans

- Executed proactive stowing for over 90% of past hail events

Proving Resilience

What set this developer apart was the evidence of resilience provided to their brokers and carriers with thorough documentation and proactive approach:

- Provided photographic evidence of the hail stow angle

- Submitted stow logs for recent months, demonstrating consistent operational implementation

- Incorporated resilience planning from the project’s design phase

The Result: Substantial Insurance Savings

kWh Analytics underwriters, recognizing the developer’s commitment to resilience, were able to offer a 72% reduction in the natural catastrophe insurance rate for this project—this significant saving directly resulted from the developer’s investment in physical hardening and operational measures.

The Takeaway

By combining physical asset improvements with smart operational protocols, developers cannot only protect their assets but also secure substantial insurance savings.

kWh Analytics values sponsor resilience measures and they do impact our premiums. We work directly with developers and brokers to ensure that investments in resilience translate into tangible financial benefits.

For more information on how your resilience measures can be factored into your insurance program, ask your broker for a kWhote.

Follow the author

Articles you may be interested in

November 11 2025

kWh Analytics Releases Inaugural Resilient Power Report: Positive Case Studies from Renewable Energy

Featuring case studies from leading renewable energy stakeholders, the report highlights the successes and lessons...

Continue reading

October 22 2025

kWh Analytics wins Sustainable Insurer of the Year and Climate Risk Transfer Deal of the...

InsuranceERM recognizes company for its innovative partnerships, sophisticated modeling, and cutting-edge automation advancements in climate...

Continue reading

October 13 2025

Rewarding Resilience: How Insurers are Incentivizing Risk Mitigation

Originally published in Canadian Underwriter Climate change is shifting the risk landscape, prompting a reevaluation...

Continue reading